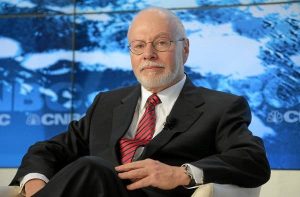

Elliott Management's Paul Singer predicted quarantine early. On February 1 the hedge fund boss warned employees around the world with an internal memo insisting that they "make arrangements so that you do not have to leave your home for a month if that becomes necessary." This was a month and a half before New York imposed a statewide lockdown to reduce the spread of the novel coronavirus.

Known for his prudent - or pessimistic - outlook Singer has a reputation for issuing warnings on market crashes and even solar storms. However, he also has a knack for getting ahead of looming downturns. In light of the coronavirus pandemic, the firm had hedges that helped protect its investments against any such decline, and its return for the first quarter was about 2.2%. Though, despite Singer's early action, the company hasn't been able to avoid the fallout from the pandemic altogether.

In 2018, Elliott Management announced it would be buying Travelport Worldwide, a provider of technology and payment solutions for the travel and tourism industry. The company facilitates travel commerce by connecting the world's leading travel providers with online and offline travel buyers in a proprietary business-to-business travel platform.

The Global Distribution System (GDS) is a travel agent's motherboard for booking airline tickets and Travelport is one of three dominant providers. To put that into perspective, half of the world's online travel bookings are made directly with airlines. Still, almost all of the remaining reservations are processed by GDS like Travelport, Sabre, and Amadeus. Travelport is the smallest of the major GDS companies with 20% of the market share while Sabre and Amadeus hold 37% and 43% of the market share, respectively.

The $4.4 billion buyout was completed in 2019. However, the pandemic caused the travel industry to become vulnerable, leaving Elliott Management's $3.3 billion in loans that was used for the acquisition at "distressed levels."

Sabre and Amadeus have taken drastic measures to reinforce their finances. While Amadeus has dropped its dividends, raised $1.6 billion and boosted credit lines, Texas-based Sabre offered bond investors a 9.25% coupon as an incentive to buy $775 million in debt.

Even though the current pandemic is unique, Travelport has experienced issues of its own long before its acquisition by Elliott. Blackstone and its partners bought Travelport for $4.3 billion in 2006, using just $900 million of their own cash and financing the rest. In 2011, the GDS almost filed for bankruptcy.

At the beginning of April, credit rating agency Fitch Ratings, which evaluates the viability of investments relative to the likelihood of default, changed Travelport's long-term Issuer Default Rating (IDR) from a B+ down to a B-.

There are worries that after the COVID-19 outbreak subsides it will already be too late. While people are itching to leave their homes, experts forecast that traveler habits will decrease in a lasting way.