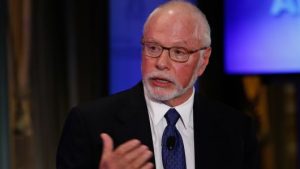

American investment firm Elliott Management, backer of software company ASG Technologies, has a certain kind of reputation in financial circles. Described by Fortune Magazine as “one of the smartest and toughest money managers in the business”, the company’s founder Paul Singer is a controversial figure. Depending on who is speaking, he is either heralded as hero activist-investor or a vulture capitalist feeding off its corporate carrion.

Founded in 1977 by Singer with $1.3 million in seed money from family and friends, the company specialized in convertible arbitrage in its early years but later diversified its approach with other investment strategies. Despite Elliott’s decision to broaden out its base, one-third of the company’s holdings consists of distressed debt acquisitions – including both corporate and sovereign securities. It is these transactions that have left their impression with various countries heads of state and corporate leadership teams.

Singer’s distinctively adversarial but enormously profitable way of doing business has led to the deposition of South Korea’s president, the unseating of several CEO’s and countless corporate restructurings. After Argentina defaulted on their debt in 2002, Elliott-owned NML Capital sued the government for full value of the debt and attempted to seize an Argentine naval vessel anchored in a Ghanaian port. After fifteen years of court battles and legal stand-offs, the country acquiesced and agreed to pay their debt in 2016.

Jonathan Bush, happy-go-lucky CEO of athenahealth, also found out the hard way that Paul Singer had eyes for his company. Following a three-day sailing race, Bush was reclining on his multi-million-dollar catamaran in Bermuda when he received a phone call from one Jesse Cohn. He politely introduced himself as a representative from Elliott Management and informed Bush that the company had bought-up a 9.2 percent holding athenahealth. It was a great company, Cohn said, but it had some problems. The bewildered Bush didn’t know it yet but that was the beginning of the end for his tenure as CEO.

The company currently holds $34 billion in assets under management and since its beginning, its investment returns has consistently outpaced the S&P 500 stock index. The company is well-known for their high returns and low volatility. According to a Fortune Magazine article, Singer was strongly influenced by losses he sustained early in his career. Consequently, he is a careful investor and it was that caution that has guided Elliott Management through four decades with only two “down years”.

There are four equity partners in Elliott Management, including Paul Singer and John Pollock who are co-chief investment officers. Gordon Singer, his son, runs the company’s London office and has also been named equity partner along with Steven Kasoff, who formerly held a senior portfolio manager position within the company.