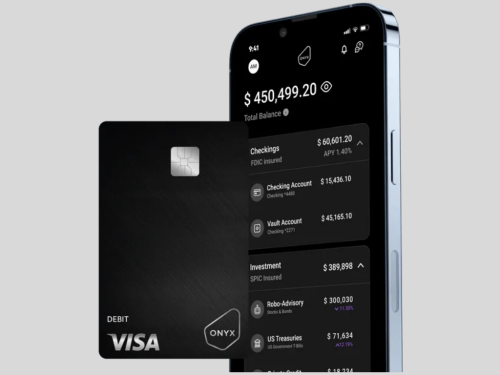

Miami-based digital bank Onyx Private, previously backed by Y Combinator, has announced the termination of its consumer banking services, as revealed in a recent email communication with customers. Co-Founder and CEO Victor Santos confirmed the transition, stating that the company is pivoting away from its B2C model towards a B2B white-label platform-as-a-service approach. This strategic shift aims to cater to community banks, regional banks, and credit unions seeking to offer digital banking solutions tailored for affluent young consumers, reflecting Onyx's evolving business strategy.

Despite previous successes, including a $4.1 million venture funding round in May 2023 and steady growth in transaction payment value, Onyx's decision to cease direct-to-consumer banking operations comes amid efforts to capitalize on existing financial institution partnerships and leverage its technology for more efficient scaling. While regulatory issues were speculated to have influenced the move, Santos dismissed such claims, attributing the shift solely to strategic considerations. The cessation of consumer banking services is scheduled for April 14, 2024, with immediate termination of the rewards program, signaling a significant transition in Onyx's business focus.